What are my loan options?

Discover your available loan options and find the perfect mortgage to turn your dream home into an achievable goal

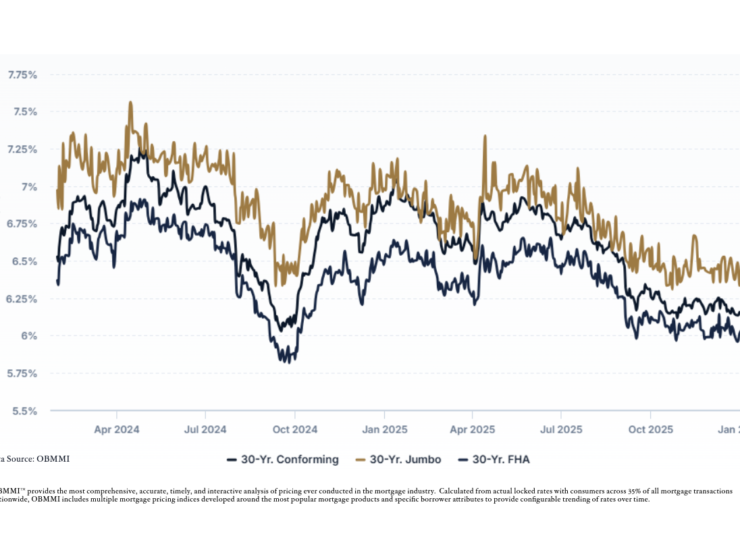

Conventional loans are the most common mortgage type in the country, making up the majority of originations. They feature fixed and variable rates and offer durations from 10 to 30 years.

FHA loans are designed to promote homeownership by assisting borrowers with lower credit scores or limited funds for down payments.

VA loans are for eligible Veterans, active-duty service members, and qualifying surviving spouses in purchasing, refinancing, or improving a home.

USDA

USDA loans are designed to make homeownership more accessible in eligible rural and suburban areas by offering affordable financing, especially for low- to moderate-income households.

If you’ve outgrown your starter home or are upgrading to a dream property, a jumbo loan helps you finance homes priced above standard limits. A jumbo mortgage is a larger loan for properties exceeding Fannie Mae/Freddie Mac conforming thresholds, making it non-conforming.

Renovation loans offer flexible financing tied to your home’s increased value once improvements are finished. Perfect for upgrading your existing home or purchasing a property with renovation potential, they help you build the ideal living environment you desire. We offer conventional, FHA, VA and fix & flip renovation loans.

Ground-up construction loans (also called construction-to-permanent loans) finance the construction of a new home from scratch, often including land acquisition, materials, labor, and related costs. These differ from renovation loans (which fund improvements to existing properties). We offer conventional, FHA and VA new construction loans.

Down payment assistance (DPA) programs provide financial help—in the form of grants or second mortgages — to cover all of a homebuyer’s down payment and sometimes closing costs (when the purchase agreement is structured properly).

A Debt Service Coverage Ratio loan (DSCR) allows borrowers to qualify for financing based on the actual or anticipated rental income, rather than personal income. Lenders evaluate whether the rental income is sufficient to cover 100% of the mortgage payment.

A bank statement loan allows borrowers to qualify based on their bank statements, rather than tax returns and pay stubs. Qualifications can be 12 or 24 months of business or personal statements.

A profit and loss loan (P&L) qualifies a business owner on their income statement instead of tax returns. Qualifications can be 12 or 24 months, giving lenders a clear picture of your earning power, taking into account tax deductions that make your reportable income lower than real cash flow.

Explore refinancing to potentially reduce your monthly mortgage payment with today’s lower rates, accelerate payoff with a shorter term, or tap into your home equity to fund renovations, payoff debt, or manage other large expenses

Articles

How can the mortgage loan officers at Scout Advisors help me get a mortgage?

The team of mortgage experts at Scout Advisors leverages a broad offering of mortgage programs and technologies to help streamline the process and get into your dream home. Learn more about all available options and apply for your mortgage pre-approval today!